Sector-Wise Quantitative Fundamental Comparison of Stocks

An Robo-Enabled Learning & Analytical Framework for Market Participants

UDTS©-VSM – Stock Fundamental Analysis Screener

A structured analytical framework designed to help investors and traders understand and compare stocks based on selected fundamental parameters.

UDTS©-VSM is an educational and analytical screener that evaluates stocks using quantitative fundamental factors such as Value and Safety parameters, along with selected technical indicators such as Momentum, for comparative analysis purposes.

The objective of the framework is to assist users in systematically studying companies and making informed, independent decisions based on data interpretation.

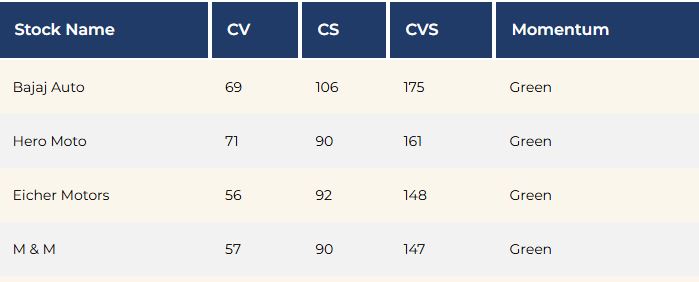

It serves as a ready-reckoner style reference tool for individuals who wish to:

Understand key fundamental ratios

Compare companies within sectors

Study valuation metrics

Track financial strength indicators

Observe momentum-based technical data for additional context

This framework does not provide stock recommendations, investment advice, return assurances, or buy/sell signals.

About Algo Screeners

Algo Screeners focuses on data compilation, structured presentation, and analytical interpretation of publicly available financial information.

The platform emphasizes data-driven analysis

No assumptions, forecasts, or return projections are made

Robo tools are used only to enhance data processing and analytical efficiency

Users are encouraged to perform their own due diligence before making investment decisions

Our aim is to support market participants with structured financial data so they can take independent and informed decisions.

Important Disclaimer

This tool is intended solely for educational and informational purposes.

It does not constitute investment advice, research recommendation, or portfolio management service.

Investments in securities markets are subject to market risks. Users should consult their registered investment advisors before making financial decisions.