Welcome to Algo Screeners

Algo Screeners is India’s first AI-powered intraday trading learning portal, built on the trusted UDTS® strategy framework. We provide real-time screeners, automated strategy building, and live market practice tools—designed to transform beginners into confident, disciplined traders.

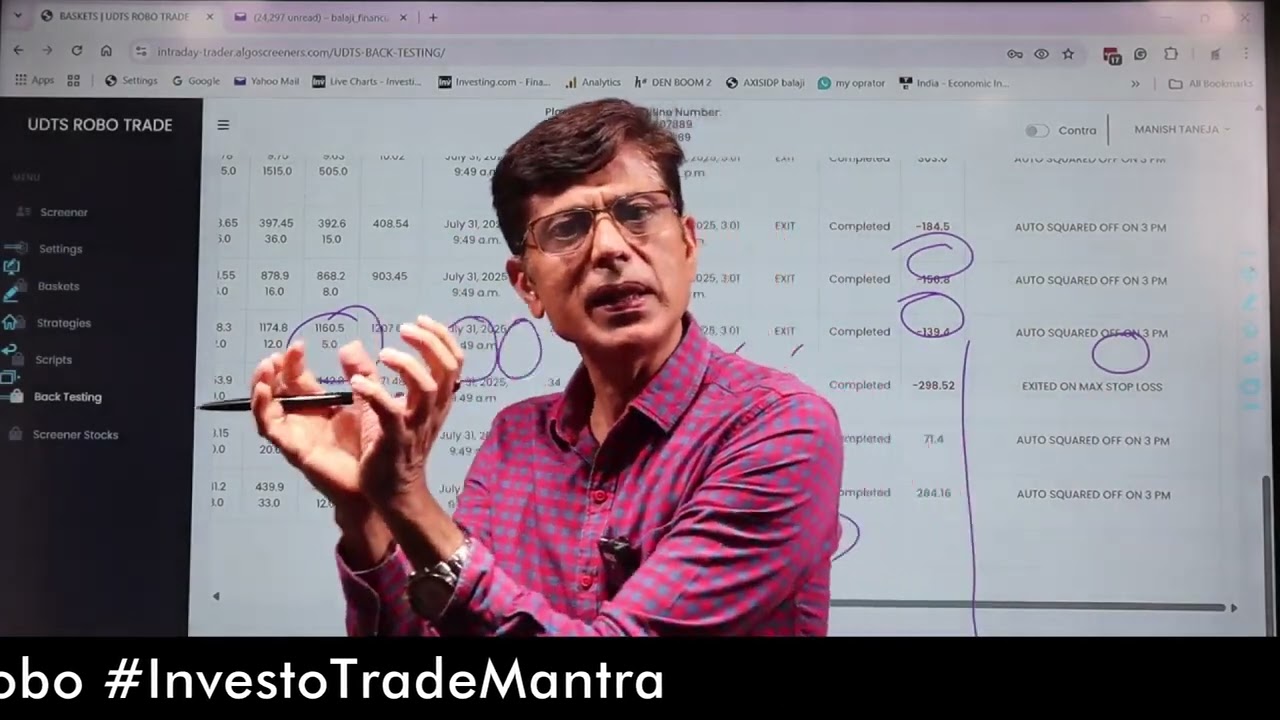

UDTS® ROBO TRADE – India’s leading AI-powered Intraday Trading Platform, officially whitelisted and compliant with Bajaj Broking (A Bajaj Finserv Ltd. Company). Powered by the proven UDTS® Strategy, it offers a safe and trusted way to learn, practice, and succeed in the Stock Market.

Next-Gen Intraday Trading with UDTS ROBO – Full Demo Guide Inside!

Playlist

11:47

9:05

14:06

12:08

10:24

11:55

11:08

18:44

14:21

15:17

18:27

🔹 About Us

Algo Screeners is a next-generation fintech platform offering advanced algorithmic tools and intelligent stock screening solutions. Our flagship offerings — UDTS® ROBO TRADE and UDTS® FUNDAMENTAL SCREENER — are designed to empower traders and investors through data-driven, logic-based decision-making.

🚀 UDTS® ROBO TRADE

India’s First AI-Powered Intraday Trading Training Portal

Blending human intelligence with artificial intelligence to help you learn, practice, and master intraday trading—live and without fear.

UDTS® ROBO Trade is a fully retail-focused product designed to learn rule-based trading. Its core objective is to stay aligned with the unidirectional trend of individual stocks and Nifty, thereby increasing winning probability, especially when trades are executed in a group or basket, rather than depending on a single stock.

It also offers backtesting features, allowing users to test their strategies thoroughly before going live in the market.

- ✅ Build and automate over 160+ custom trading strategies

- ✅ Practice in live market environments with minimal capital risk

- ✅ Eliminate emotional trading, tips, and guesswork

- ✅ Master the technical, fundamental, and psychological aspects of trading

📊 UDTS® FUNDAMENTAL SCREENER

Create powerful, customizable stock filters using a broad range of technical indicators and fundamental data. Built on real-time market feeds and proven logic, this tool helps you identify stocks with strong quantitative fundamentals.

🔍 Why Choose Algo Screeners?

- ✔ Real-time stock screeners with intelligent filtering

- ✔ Rule-based strategy builder backed by market-tested logic

- ✔ Emotion-free, checklist-based execution model

- ✔ Live market simulation for hands-on practice and risk control

🎯 Learn. Practice. Execute.

At Algo Screeners, we don’t just offer tools — we offer transformation. Our platform is designed to help traders become self-reliant, consistent, and successful, backed by technology and disciplined strategy.

Overwhelming Data Volume

With over 8,000 stocks listed in the Indian stock market, it becomes nearly impossible for an individual to analyze every single one using fundamental and technical analysis. These tools, while powerful, require a lot of time, effort, and attention to filter through vast amounts of data. This process becomes even more challenging when stock market conditions change rapidly.

Market Volatility

The stock market can be highly unpredictable, with price movements influenced by a variety of factors, including news, earnings reports, global events, and investor sentiment. Even the most sophisticated strategies can falter in the face of sudden market changes or volatility.

Human Limitations:

Despite having the knowledge of technical and fundamental analysis, humans are prone to biases, emotional decisions, and errors. Traders and investors may also misinterpret or overlook important signals, which could lead to losses. The speed at which decisions must be made in intraday trading, for example, is something humans struggle to match compared to machines.

Inability to Execute Quickly

Even if a trader has identified a good opportunity, acting on that information at the right moment can be difficult. Stock prices can change in the blink of an eye, and manual execution of trades may result in missed opportunities or losses.

What Is Algoscreeners

Algo Screeners is an innovative financial technology platform offering advanced algorithmic tools and comprehensive stock screening services. Our flagship products, UDTS ROBO TRADE and UDTS FUNDAMENTAL SCREENER, are specifically designed to empower investors and traders in identifying high-potential opportunities.

By harnessing sophisticated algorithms, our platform provides real-time market data and financial metrics, enabling users to create a fully customizable stock screener. These screens can be tailored using a wide range of criteria — from technical indicators to fundamental analysis parameters — providing a data-driven edge for making smarter, faster, informed decisions.

UDTS© ROBO TRADE –🚀 India’s First Live Market Intraday Learning Portal. The Ultimate AI-Powered Solution for Intraday Traders-

India’s 1st Live Market Learning Portal – Build 160+ Strategies & Trade Fearlessly with UDTS Robo!”

Empowering traders with real-time intraday training and strategy-building tools.

✅ Create 160+ custom intraday strategies using advanced AI

✅ Powered by proven UDTS algorithms

✅ Learn, analyse, and practice in live market conditions—without fear!

Experience the future of intraday trading – logic, speed & precision, all in one platform.

UDTS© Robo Trade Algo is a next-generation, AI-driven trading solution designed to revolutionize intraday trading for retail investors. By harnessing the power of machine learning and artificial intelligence, traders can make informed decisions based on various information on stock trend, Nifty trend, and different ratios of market data and execute trades automatically at a speed far beyond human capability. This levels the playing field for retail traders, enabling them to compete with the sophisticated, high-frequency systems typically used by institutional players.

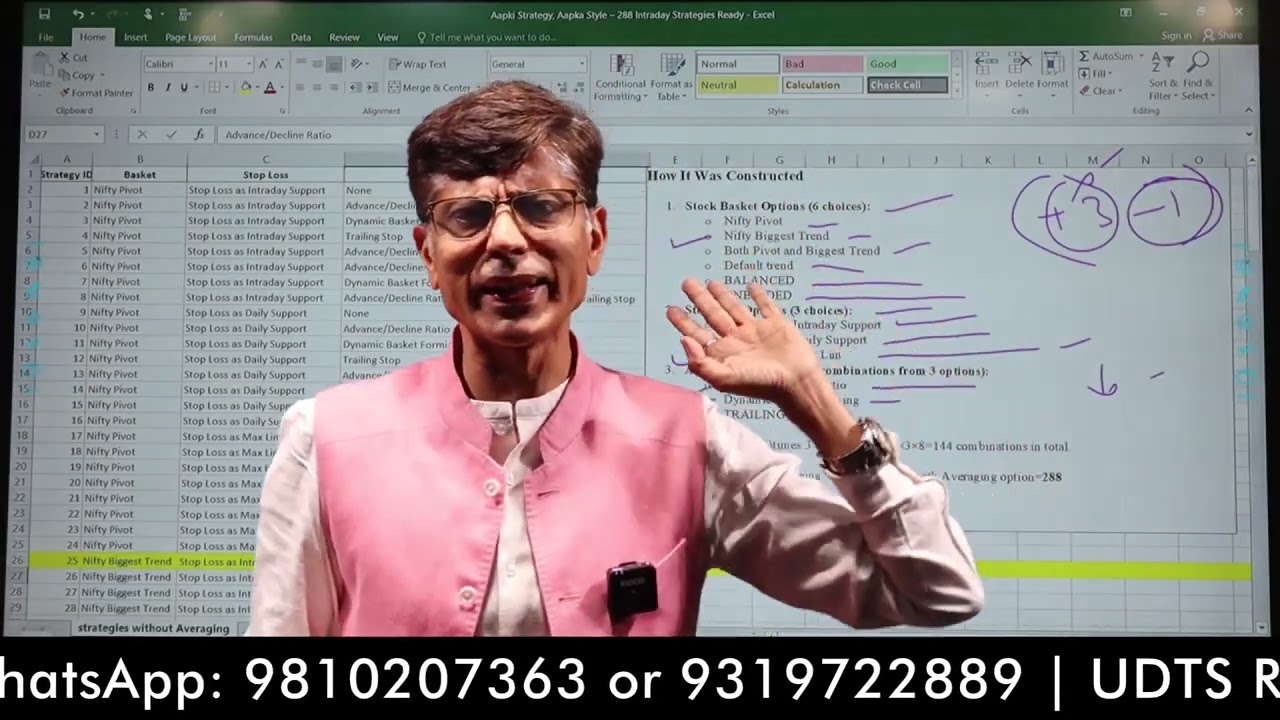

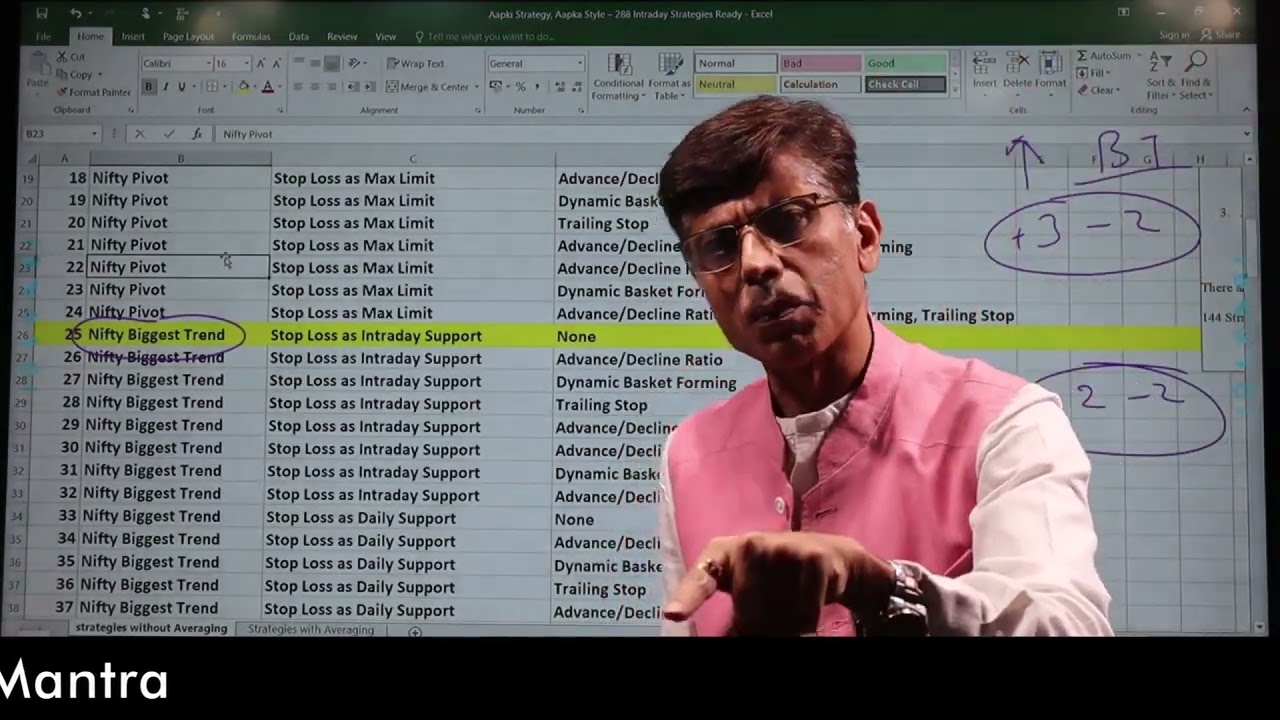

At the core of UDTS© Robo Trade lies the UDTS© Strategy, meticulously developed by renowned trader and author Mr. Manish Taneja. This strategy integrates eight key parameters, focusing primarily on price action to pinpoint optimal entry and exit points, maximizing winning trades while managing risk. The software uses algorithmic trading technology, where predefined rules trigger automatic order execution at speeds no manual trader can match.

Additionally, the platform offers a “white-box” open-source model, enabling users to customize, modify, and even build their strategies without coding expertise. Both novice and experienced traders benefit from this flexibility, as it allows collaboration, innovation, and strategy refinement.

Why AI is Essential for Modern Intraday Traders

Intraday trading continues to attract over 80% of market participants due to its high-reward potential. However, its volatile, unpredictable nature makes price direction forecasting highly challenging. With the right AI tools and strategic frameworks, traders can significantly improve their odds of success.

AI-powered trading systems combine rule-based models, technical analysis, candlestick patterns, and backtesting to validate strategies using historical data. This not only enhances forecasting accuracy but also strengthens decision-making processes. Together with effective risk management and market analysis, this ensures a well-rounded trading plan.

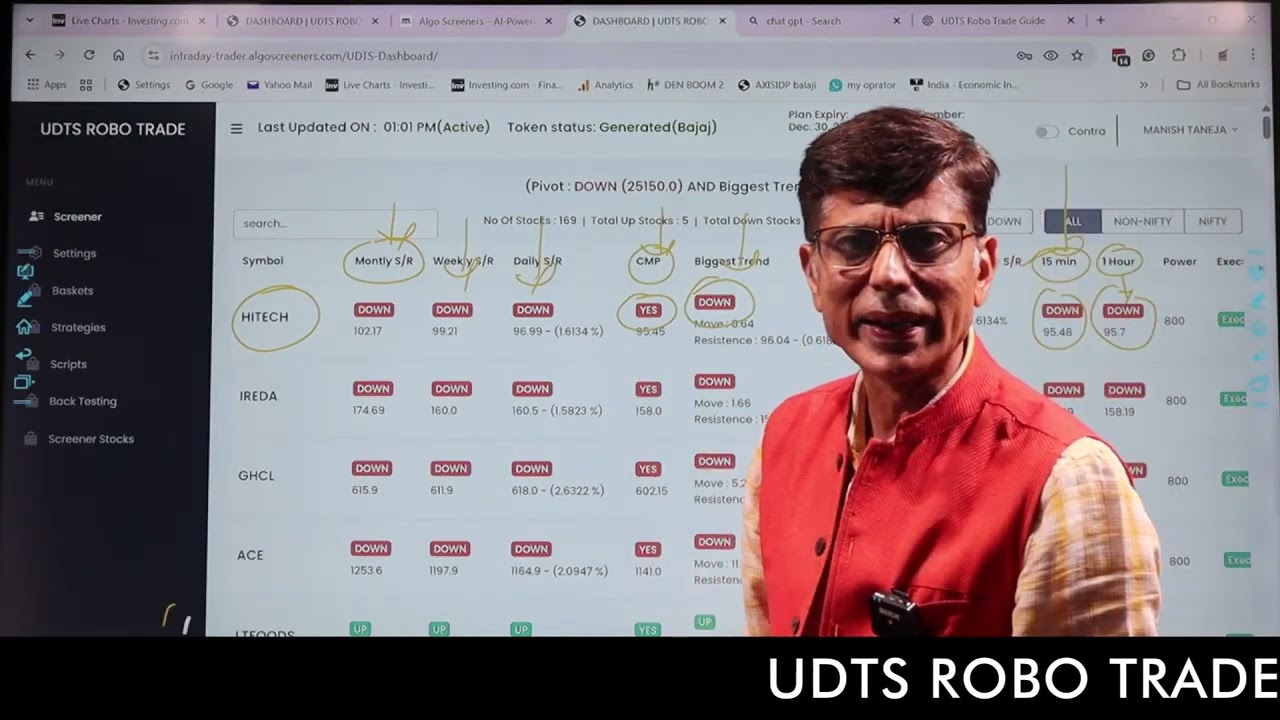

The Logic Behind UDTS ROBO TRADE

The UDTS Robo Trade system employs a multi-layered, disciplined approach, integrating 12 vital parameters to improve trading success. Here’s a breakdown of its core components:

Key Parameters:

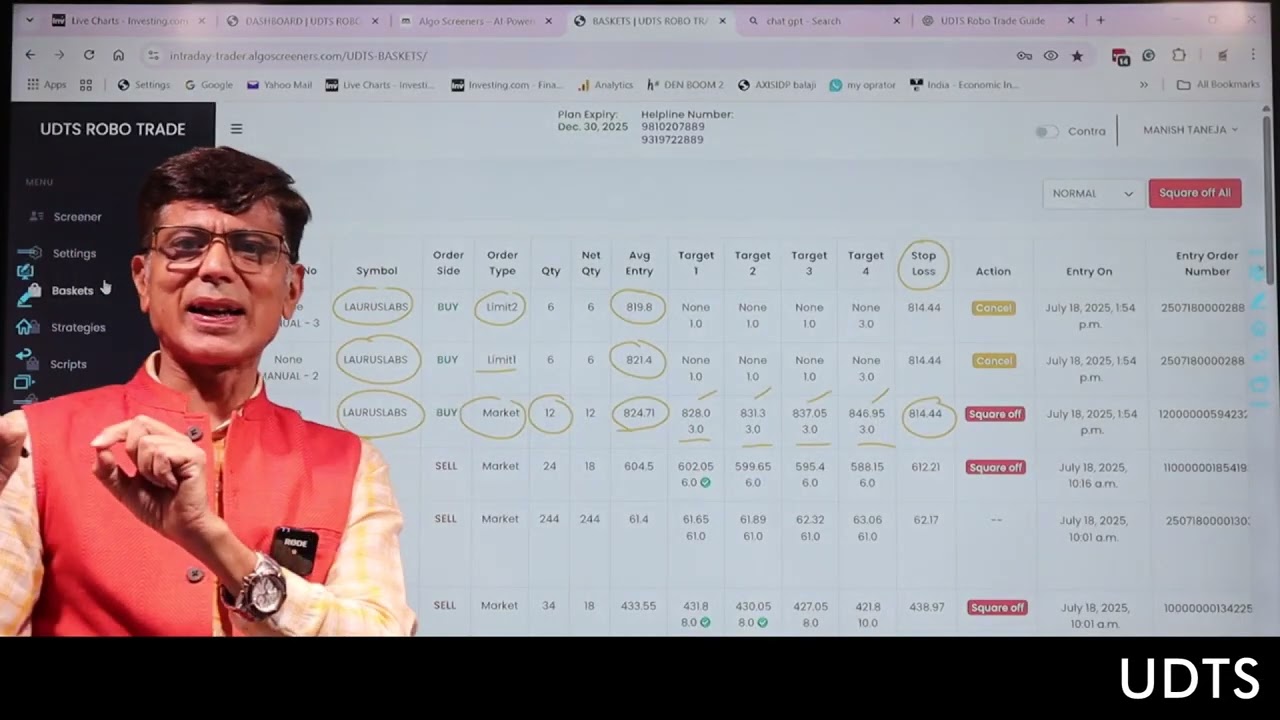

- Stock Screening:

Uses 8 unique parameters across multiple time frames (Monthly, Weekly, Daily, Intraday, Hourly, and 15-minute charts) to filter stocks where the current market price is above daily support. - Basket Creation:

Forms a stock basket based on Nifty’s intraday and prior day trends, balancing bullish and bearish positions. - Advance-Decline Ratio Check:

Validates market breadth before placing trades. - Order Placement:

Executes the trade basket when all conditions align. - Amount Allocation:

Divides investment into three portions—Market, Limit 1, and Limit 2 orders—to optimize average cost. - Selling Strategy:

Executes sales across four predefined targets to maximize profits. - Customizable Stop-Loss:

Traders can choose between different stop-loss types (Intraday Support, Daily Support, or Maximum%) with a fallback maximum loss limit.

This disciplined structure prioritizes risk control while capturing opportunities across price movements.

How UDTS ROBO TRADE Works: A Step-by-Step Guide

UDTS© Screener for Stock Selection

The screener is price action-driven, identifying stocks with significant demand or supply signals through multiple time-frame candlestick charts. Its focus is to track unusual market activity indicating potential breakouts or breakdowns.

Key Features:

- Multi-time frame analysis

- Identification of high demand/supply stocks

- Eight advanced filters for candlestick pattern recognition

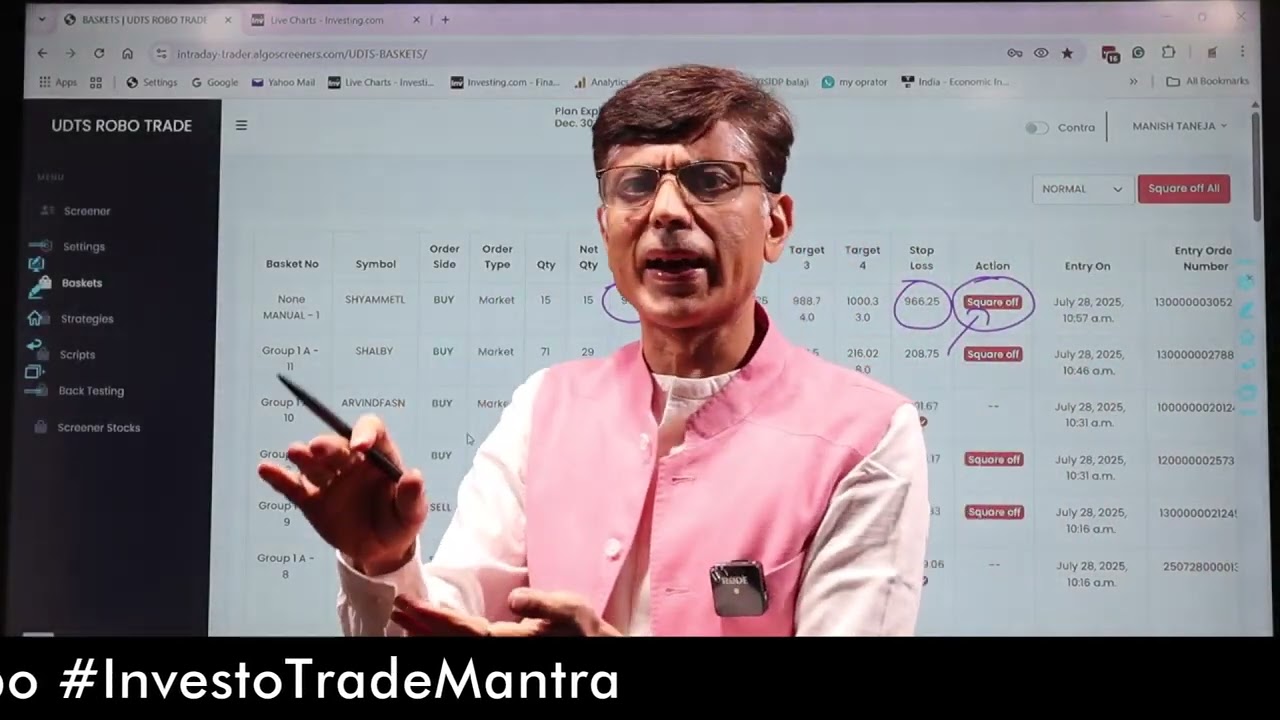

Manual & Auto-Trade Options

Traders can operate in either manual or automated modes:

Manual Trading Features:

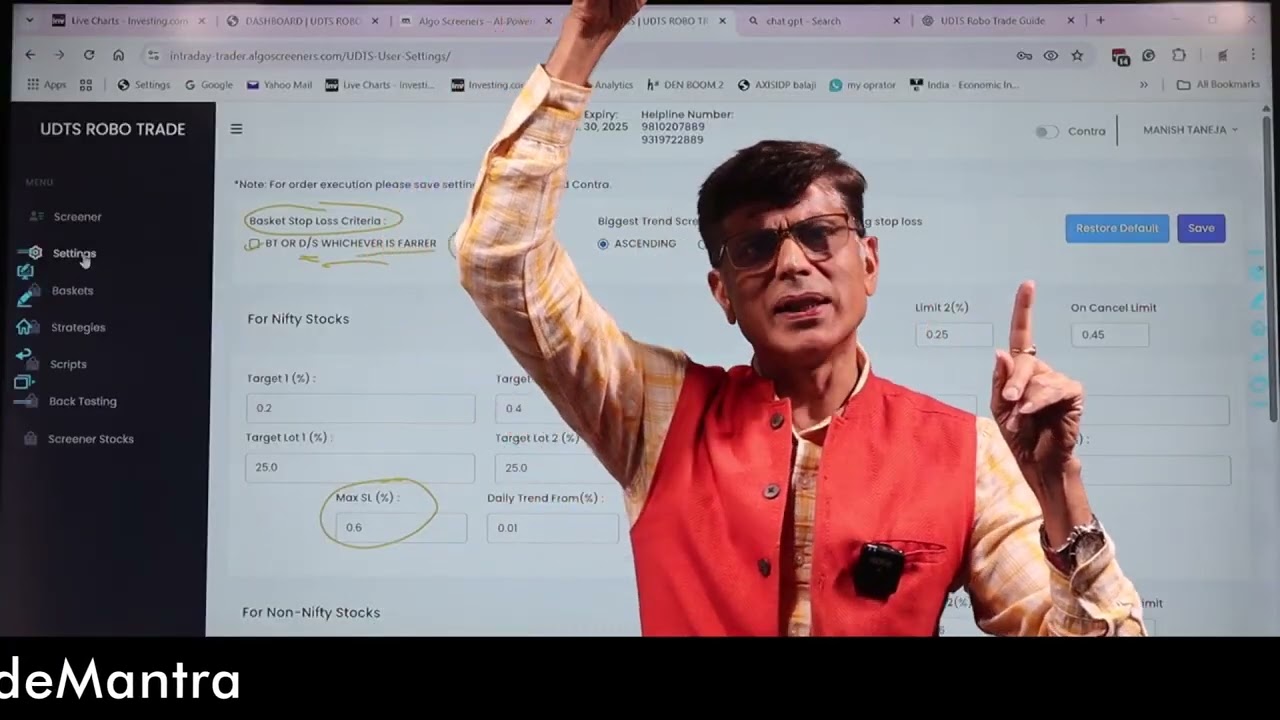

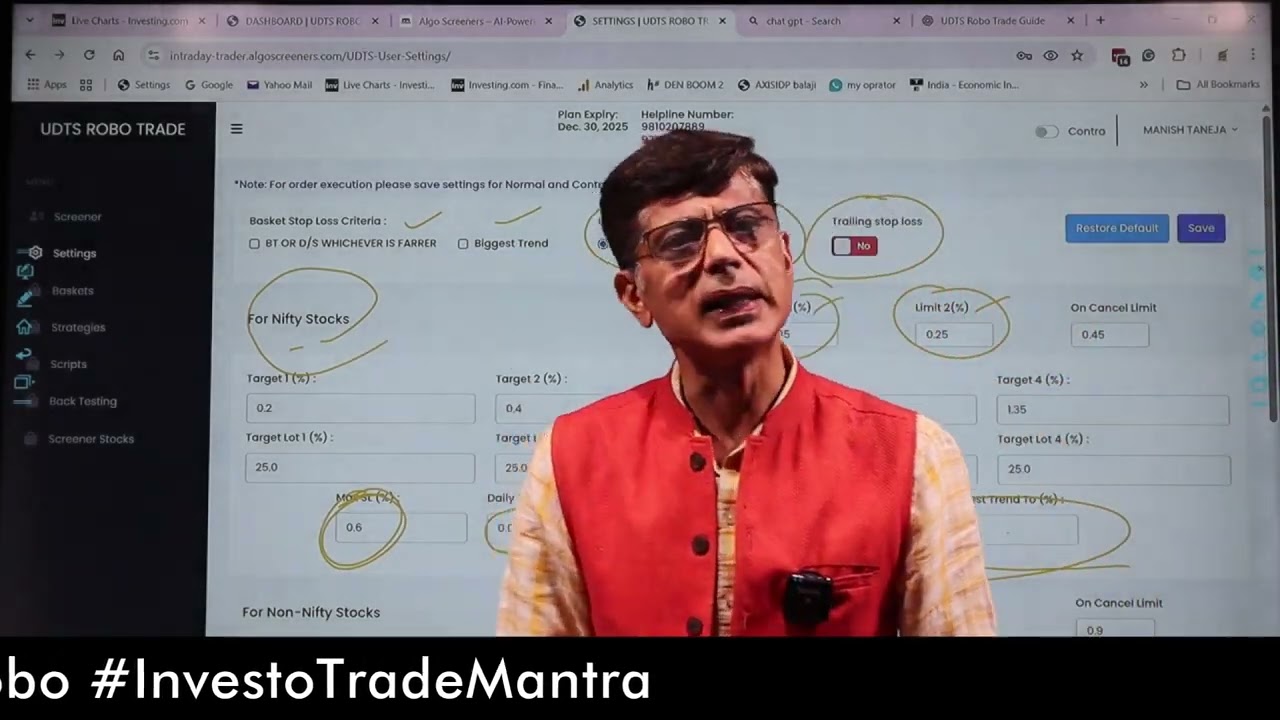

- Pre-set Parameters: Customizable stop-loss options, averaging percentages, and profit targets

- Adjustable Screener Settings: Modify screener criteria based on percentage movements relative to previous and intraday support levels

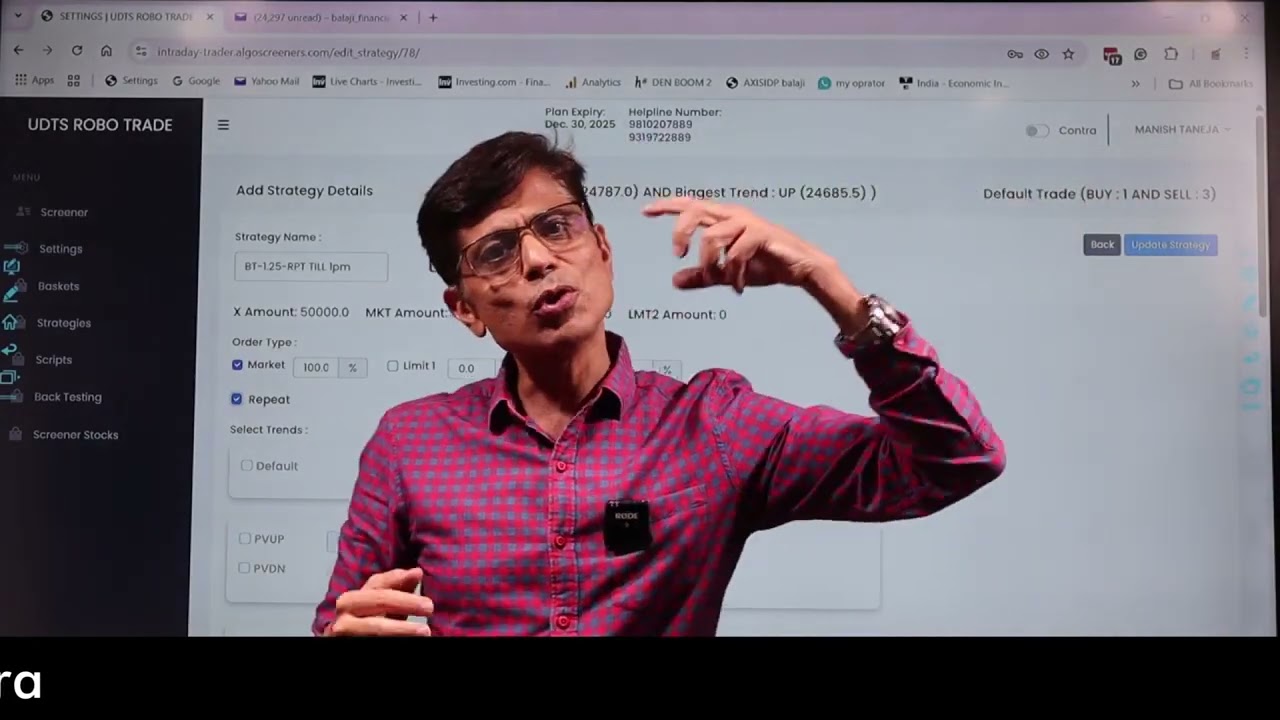

Auto-Trading Facility:

A fully rule-based auto-trade option for hands-off execution. Traders can predefine:

- Stop-loss configurations

- Profit targets

- Position sizing

- Market condition triggers

- Custom entry/exit signals

The system autonomously places trades based on real-time screener output and predefined strategies.

Dynamic Basket Management

Adjusts stock selection based on Nifty index trends and Advance-Decline ratios:

- Bullish Market: Emphasizes long positions in bullish sectors.

- Bearish Market: Prioritizes short positions or hedging tactics.

Comprehensive Features for Custom Strategy Building

- Custom Strategy Naming

- Multiple Stop-Loss Configurations

- Target Settings for Profit Goals

- Dynamic Position Sizing Based on Risk Per Trade

- Full Strategy Automation

- Advanced Risk Management Tools (Trailing Stops, Risk/Reward Ratios)

- Backtesting and Simulation

- Real-Time Monitoring and Alerts

- Contra Trade Facility for reacting to sudden market reversals.

Key Benefits of Using UDTS ROBO TRADE

- Fast, Efficient Stock Selection using real-time demand-supply analysis.

- Time-Saving Automation for both trade identification and execution.

- High Customizability for both manual and auto-trading modes.

- Adaptability for All Skill Levels — suitable for beginners and seasoned traders.

- Superior Speed & Efficiency in capturing small, rapid price moves and arbitrage opportunities.

Conclusion

UDTS© ROBO TRADE is a powerful, AI-backed trading platform built around the proven UDTS© strategy. It offers a balanced blend of manual control and automated execution, making it an ideal solution for traders aiming to capitalize on intraday opportunities through intelligent, data-driven decision-making.

The software provides several advanced tools:

Automated Technical and Fundamental Analysis

Automated Technical and Fundamental Analysis

Risk Management

Risk Management

Time Efficiency

Time Efficiency

Real-Time Alerts

Real-Time Alerts

Customization

Customization

By leveraging AI, traders and investors are empowered to take INFORMED DECISIONS:

Overall, AI’s ability to manage, analyze, and act on large volumes of data at speed provides a significant edge for traders, whether they are trading intraday or making long-term investments. Algo Screeners brings that cutting-edge technology directly to individual traders, making complex market analysis and decision-making more accessible and efficient.

AI finds the stocks with the highest potential based on historical data, real-time market trends, and predictive modeling.

The platform offers automation features like auto-trading based on predefined strategies, so traders can take advantage of opportunities without needing to constantly monitor the market.

With the right data and insights, traders can make more informed, calculated decisions rather than relying on gut feelings or emotions.

This is where Artificial Intelligence (AI) and Machine Learning come in.

AI-powered systems can process vast amounts of data in real time, filter through thousands of stocks, and identify the best opportunities with much greater efficiency than a human can. These systems are capable of automating trading and risk management processes based on predefined strategies, reducing the potential for human error and improving overall decision-making.

AI’s Role in Intraday Trading :

AI can analyze historical data, track real-time trends, and evaluate patterns much faster than humans, allowing traders to make decisions based on up-to-the-minute information.

AI can automatically execute trades, adjusting parameters like stop-loss and take-profit points based on preset strategies. This reduces the emotional and human error factor, ensuring that trades are executed as planned.

AI can run simulations using historical data to refine strategies, helping traders fine-tune their approaches before deploying them in live markets.

AI helps in managing risk by automating the process of setting stop-loss orders, adjusting positions, and monitoring volatility, ensuring that traders protect their capital during unpredictable market conditions.

Our Products

Screeners & Software's

Automates trades based on a pre-defined set of rules, making it easier for traders to follow their strategies consistently.

UDTS VSM - The Fundamental Screener

Uses the UDTS-VSM strategy to evaluate stocks on parameters like value, safety, and momentum, making it easier for investors to make informed decisions based on a company’s fundamentals.

In summary, AI’s ability to analyze large amounts of data quickly and efficiently allows traders to compete on a more level playing field, especially in the fast-paced world of intraday trading. Leveraging AI and machine learning tools for analysis, execution, and risk management greatly enhances the chances of success in the stock market